Why not take a look at our what your pension might look like page to see what this could look like for you. Or learn more about how your pension works.

Register for My USS today to manage your membership, view your benefits and savings, update your details, and keep on top of your pension.

A few other things to consider:

If you have pension savings elsewhere that you haven’t started taking yet and your previous scheme is registered with HMRC, you could transfer them to USS.

The funds you transfer will go into your Investment Builder pot, which is the defined contribution (DC) part of USS. Visit transferring in to USS for more information.

The Investment Builder – the defined contribution (DC) part of USS – lets you save a bit extra. You can make additional contributions in My USS, which will go into your Investment Builder pot. These can be regular contributions or a one-off payment.

Visit our Investment Builder page for more information.

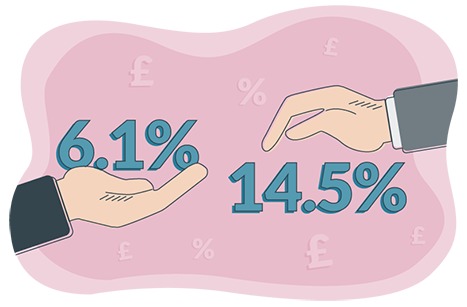

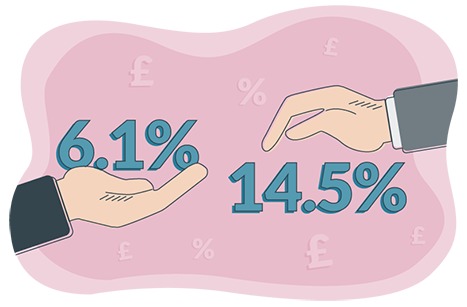

Contributions are paid by active members and their employers. You will pay in 6.1% of your salary each month and you get tax relief on your contributions, so some of the money that you normally pay towards tax goes into your pension instead.

Your employer pays in 14.5% of your salary each month towards your benefits and running USS. You can also pay additional contributions to the investment builder to save more. Visit what you’ll pay, for more information on what the contribution rate is.

Visit what you pay and what you'll get, for more information on what the contribution rate is.

If your employer offers salary sacrifice, you can agree to give up the part of your salary that you would pay towards your pension, and your employer will pay your contributions for you. Then, you (and your employer) could pay lower National Insurance contributions.

However, there are reasons why this may not be right for you. For example, if you’re with USS for less than two years, and you use salary sacrifice, you’ll still be able to choose to keep pension benefits in USS or transfer them to another scheme, but you won’t have the option to get a refund of contributions when you leave. It may also affect the amount you’re eligible to borrow, if you’re looking for a mortgage or other finance. You should speak to your employer for more details.

If you’re working for a USS employer on a fixed-term contract, you can still join USS to save for your future. If you’re eligible, your employer will auto enrol you unless you tell them otherwise.

You can join for the duration of your contract and still build up benefits. Your employer will also contribute towards your benefits.

See what your pension might look like for more information and have a look at what you pay and what you’ll get to see a full list of benefits.

Even if you’re only here for a short while, it’s still important to save for your future to make sure you achieve the future lifestyle you want.

You’ll build up more than just a pension too – have a look at what you’ll get as a member to see a full list of benefits.

A pension is an easy way to save for your future. You may receive the State Pension when you retire, but it might not be enough. Putting money away now means you’ll have a bigger income in the future. Plus, your employer contributes too – making up a big chunk of your pension.

However, if you paid in for less than two years by the time you leave, you should consider the following:

When your fixed-term contract is renewed, or when moving between USS employers, the benefits you build up in your new role will be automatically added to the ones you’ve already built up.

However, if you made additional contributions to the Investment Builder in your previous role, you’ll need to set these up again in My USS.

If you were paying Final Salary or Career Revalued Benefit additional contributions, you'll need to let your new employer know. If the gap between your previous role and your new one is more than a month, you won’t be able to continue these Final Salary or Career Revalued Benefit additional contributions.

If you’re in the UK for a fixed-term contract, you can still build up benefits with us. Even if you’re only here for a short while, it’s just as important to save for your future to make sure you achieve the future lifestyle you want. You’ll build up more than just a pension too – such as life cover should the worst happen. Have a look at what you’ll get as a member to see a full list of benefits.

If your contract with your USS employer ends, you won’t lose the benefits you’ve built up in the Retirement Income Builder (defined benefit). These will remain secure until you’re ready to take them. Any Investment Builder (defined contribution) savings will remain invested until you're ready to take them (which you can do from age 55 onwards, rising to age 57 for certain members in 2028). The amount in your pot when you come to take these savings will generally depend on the performance of your investments.

If you want to take your savings with you, you may be able to transfer your benefits and/or savings to another overseas pension scheme.

And even if you’re thinking of retiring to the other side of the world, we’ll still be able to pay your pension to you.

Take a look at our Working or retiring overseas factsheet for more information.

If you’re working for a USS employer and are eligible to join USS, you can join until the day before your 75th birthday.

Visit what you pay and what you’ll get to see a list of USS benefits.

There are two main different types of workplace pension – a defined benefit pension (like the Retirement Income Builder), which guarantees you an income for life once you retire, and a defined contribution pension (like the Investment Builder), where contributions are invested into your own savings pot. USS has both, making us a hybrid pension scheme.

To find out more visit a pensions overview. Or for more on how USS works, visit your pension explained.

Your member number will be on any emails you receive from us, your welcome letter and your Annual Member Statement. Please note that you typically won’t receive your first Annual Member Statement until the Autumn after you join. But it could be longer.

If you’ve not received either of these yet, you can get in touch with our Member Service Team on 0333 300 1043. Lines are open 9am - 5pm, Monday to Friday.

Your previous employer will send us a leaver notification and, if you’re eligible for a USS pension in your new role, your new employer will send a joiner notification. You’ll then be able to continue building your pension.

Depending on when your employers submit their notifications, you may not start paying in until the month after your new role starts.

If you want to continue making additional contributions, you’ll need to set these up again in My USS. More information can be found in your welcome letter, which you can download in My USS.

You can re-join USS at any time – speak to your employer first. They'll then send a joiner notification to us. You’ll then be able to continue saving for your future.

How much we refund you will depend on various things like how long you’ve been paying in and if you contributed via salary sacrifice. Even if you don’t get a refund, you can still take your pension at retirement or you may be able to transfer your pension elsewhere.

For more details on when a refund will and won’t be possible, take a look at getting a refund.

Get useful resources and find out the sorts of things we can provide you with

Understand what it means to be an employer offering a USS pension to your employees

© Universities Superannuation Scheme.

All rights reserved. 2024